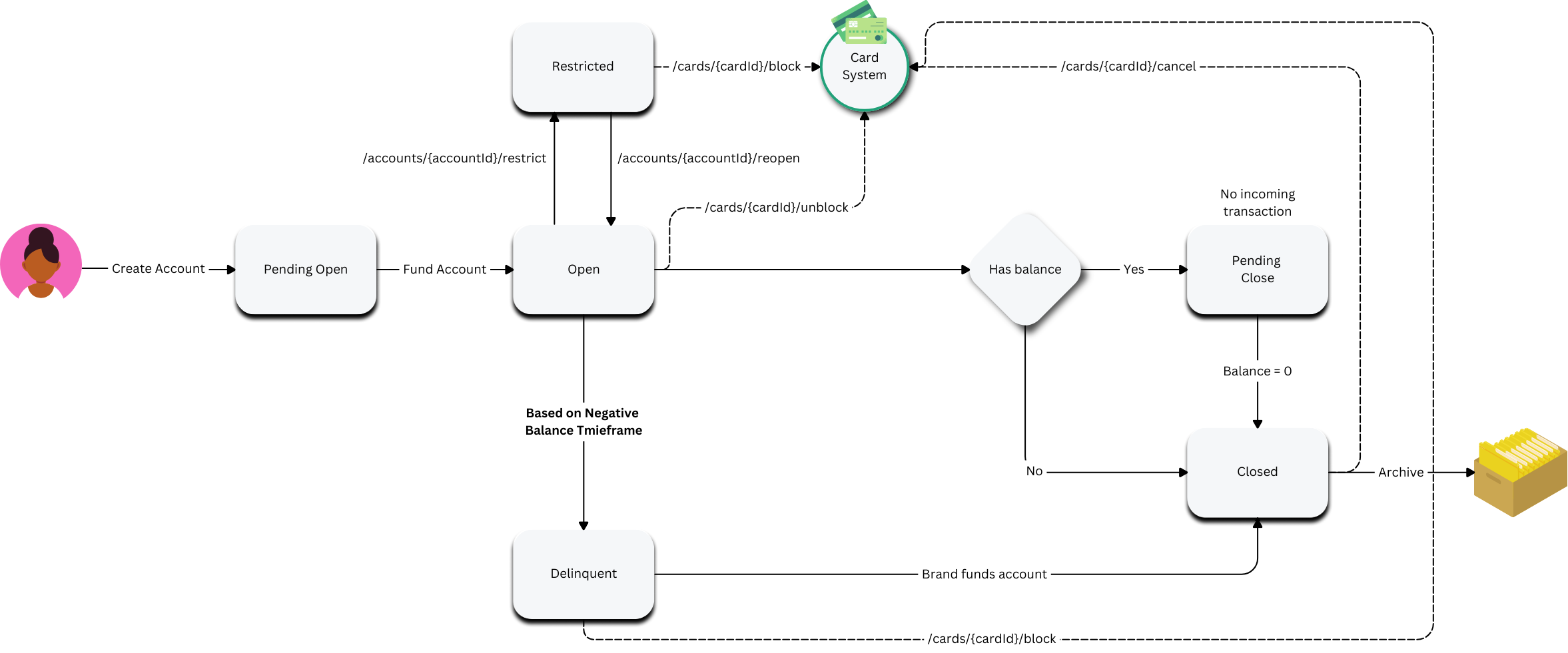

Account State Management

Let's start our Accounts journey with State Management. We put careful thought into how our Account States operated, allowing for integration into our Card System, with varying rules based on a Program’s risk level.

Key Points

- Accounts are created in a Pending Open state until an Account is funded.

- Accounts cannot be opened until KYC/KYB is done on the customer that owns the account.

| Status | Description |

|---|---|

| Closed | Closed by the account holder. This is a soft delete, but a terminal state where the user cannot reopen the account. |

| Delinquent | The account has had a negative balance for an extended period and now is Delinquent. Default to 60 days. |

| Open | The account is available to transact in any way. |

| Pending Close | When an account is requested to close but is still holding a balance. In this case the user can withdraw funds but cannot deposit funds, and the state will be Pending Close. |

| Pending Open | When an account is waiting to be funded. |

| Restricted | When an Account has been blocked due to Fraud Risk. This account cannot make or receive any transactions. |

Account States to Card States:

| Account State | Card State | Description |

|---|---|---|

| Restricted | Blocked | When an Account is restricted, we require that no transactions should occur on this account, which means all Cards must also be Blocked. |

| Delinquent | Blocked | When an Account is Delinquent, we need to Block the card so that no transactions can happen. |

| Closed | Cancelled | When an account is closed all cards for that account should be cancelled. |

| Open (Reopened) | Unblock | If a Restricted Account is Reopened, then the Cards for the Account need to be Unblocked. |

Related Links:

- API References: Under Accounts -> Accounts State Management