Account Overview

Accounts are a central resource that store value and provides a foundation that all other systems and features build on top of.

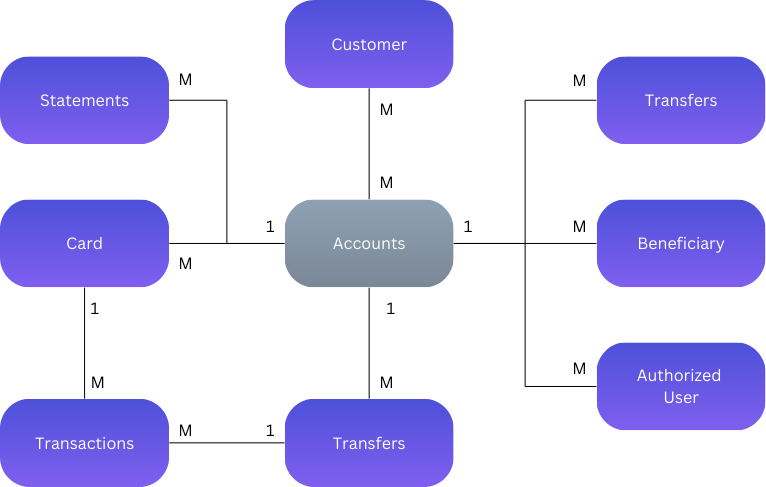

In the object model above, you can see an illustration of how different features and resources connect to an Account in the Interlace, and how a FInTech can use these building blocks to create various use cases, with the following features:

Next Topics

Related Topics

- Transfers: For Transfer related topics see Money Movement

- Card: for Card related topics see Card