Introduction

Launch your Fintech with confidence

We are developers too – with deep domain expertise in financial services. We understand that to be successful, you need the tools, guidance, and support to be able to quickly create, deploy and test your applications.

Our Finance Packs accelerate your delivery cycles.

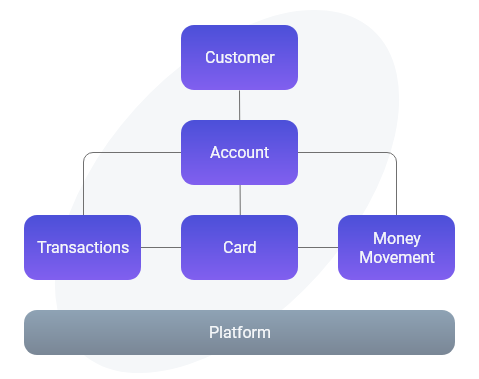

While you can easily jump in the API specifications and start orchestrating your calls and events, in this section we provide a high-level summary of our platform product sets. We organize these in the following product packs:

Customer pack

On the interlace platform, we associate a customer to your end-customer or application user for which you are offering a financial product. A customer is an individual or business that opens an account with your brand, logs into your application, or makes purchases or payments.

The Customer Pack includes the services, events, and schemas associated with the verification, creation, inquiry, and maintenance of your customers.

Account pack

Customers can have one or more accounts. An account is typically a financial product such as a savings, loan, or credit card account and is tracked on the provider’s system of record. The interlace platform supports various account types and each has specific profiles, transactions, and user-based permissions.

The Account Pack includes the services, events, and schemas associated with the account applications that grant the creation, inquiry, and maintenance of your customer’s accounts.

Card pack

The interlace platform currently supports the activation, use, and maintenance of debit cards. Debit cards allow the customer to make purchases by drawing on funds that are already within their bank account.

The Card Pack services include the ability to initiate, verify and create a new card. Once the card is available, additional services provide card management for PIN reset and re-issuing along with various card control services.

For card purchases, the Card Pack offers card authorization for payments with all activity being tracked within the platform transaction log and event history.

Money Movement pack

Customers can move money in various ways, including making payments. Money movement applies to those customers opening a new account and wanting to fund the account, for those customers wanting to make transfers or wires, or those customers that want to make payments towards their loans, credit cards, or other financial products. The interlace platform supports various account types and each has specific money movement capabilities based on how you configure the products.

The Money Movement Pack includes the services, events, and schemas associated with initiating, inquiry, and tracking monetary transactions.

For each of these, we provide an overview of the primary features and schemas that are included on the platform. This is a good place to start to get a quick introduction into our products.

Within each pack, you will find a set of services that typically provide the ability to create, inquire and update entities along with the ability to initiate and view transactions performed on the platform.

We also recommend that you review the Get Started section to understand the basic principles.