Money Movement Overview

Overview

On the interlace platform, customers can move money in various ways, including making payments. Money movement applies to those customers opening a new account and wanting to fund the account, for those customers wanting to make transfers or wires, or those customers that want to make payments towards their loans, credit cards, or other financial products. The interlace platform supports various account types and each has specific money movement capabilities based on how you configure the products.

The Money Movement Pack includes the services, events, and schemas associated with initiating, inquiry, and tracking monetary transactions.

At a summary level, the services and schemas for the Money Movement Pack include the ability to make internal and external transfers (ACH), real time payments, bill payments, wires, and more.

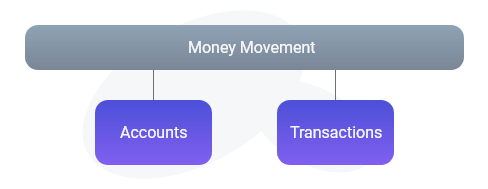

Schema

The following chart shows the data relationship between the money movement object and additional interlace objects related to monetary transactions. While Money Movement is a type of monetary transaction, we reflect the Transaction object in the schema diagram to denote that any monetary transaction has an association with the platform transaction logs, transaction details, and transaction images.

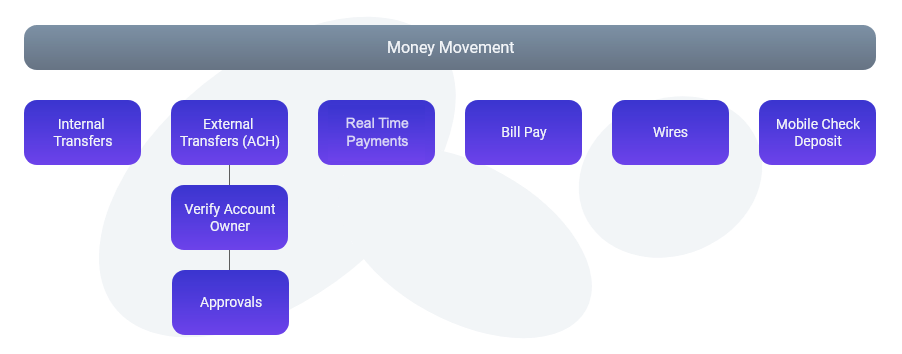

Use Cases

The following chart shows the various monetary types (service interactions) associated with money movement on the platform.

Internal Funds Transfer

An internal funds transfer refers to the electronic transfer of funds between two accounts that reside within the same financial institution. In this case, the verified bank customer can easily transfer funds as the account ownership and account status are known.

Internal transfers can be set up as a one-time transfer, scheduled transfer, or recurring transfer. In addition, you can inquire to get a list of all pending transfers or update a pending transfer.

To perform a transfer, please refer to the Money Movement / Transfers section in our API reference.

External Funds Transfer

An external funds transfer often referred to as an ACH transfer, is the electronic transfer of funds between two accounts that reside within different financial institutions. In this case, funds can be transferred from the external bank account to another bank account of the same customer, to another person’s account such as friends or family, or to pay bills.

To securely transfer funds between U.S. financial institutions, the funds pass through the Automated Clearing House secure network. Your bank submits a request to the ACH network to transfer funds between the accounts you’ve specified. ACH then uses its own secure channels to complete the transaction.

The platform also provides the capability to verify the ownership of the external account prior to the ACH request being initiated.

To perform an external funds transfer, please refer to the Money Movement / ACH section in our API reference.

Real-Time Payment

Real-Time Payments (RTP) is the fastest method of moving money with the lowest fees. Real-Time Payments are implemented by two services FedNow and The Clearing House’s RTP®, both are instant payment methods. The Clearing House (TCH) RTP® was launched in 2017, while FedNow goes live in 2023.

At infinant we support the ISO 20022 standard for message sending and receiving, making our solution compatible with both THC RTP® and FedNow. Infinant’s white-label RTP solution processes payments from a payment instruction file (PIF) or a prefabricated (prefab) user experience that either the bank or infinant creates. This prefab can be easily embedded within an online banking application or 3rd party application to support your embedded finance business models. On the backend, infinant’s solution applies a logic layer with customizable rules for banks and their commercial clients to execute their payables and cashflow management strategies, by intelligently routing payments to the optimal rail type.

For a custom solution, integrate with our APIs directly. To test our RTP APIs in a sandbox environment, please refer to the RTP section in our API reference.

Primary Use Cases

| Customer | Use Case | Description |

|---|---|---|

| Commercial | Credit Transfer | Commercial clients can send a one-time payment to a vendor, to take advantage of dynamic discounting incentives. |

| Commercial | Accounts Payable | Send your payment instruction files to infinant’s payment facilities, configure supplier rules, and funding sources based on transfer amounts, supplier type or other criteria. |

| Commercial | Request for Payment | If your commercial clients have an invoice being sent out to a customer, provide them with a fast and easy payment option through our Request for Payment feature. |

| Consumer | Credit Transfer | Engage consumers with a P2P option to send money in real-time to friends, family and small businesses. |

Bill Pay

Bill Pay systems allow customers to have a single place to easily organize and pay bills when due. Bill Pay platforms have become commonplace within bank and credit union online applications. The Bill Pay solutions allow customers to avoid going to each individual provider’s website (phone, water, electricity, cable, etc) to pay their bills. The Bill Pay system allows you to access all your bills from their online banking app or stand-alone mobile app.

As part of the Bill Pay services, you can also manage your Bill Pay Payees. A payee is the provider or recipient of your payment. If you are paying a utility provider for the first time, you need to provide your bank with your account number and billing address for instance to complete the first-time authorization to allow your bank to disperse funds.

To review the Bill Pay services, please refer to the Money Movement / Bill Pay section in our API reference.

Wires

Wires are a type of monetary transfer with the primary difference is that the funds typically leave the customer’s account immediately.

Similar to Bill Pay services, the customer will need to provide the payee bank name, routing number, and payee account number to authorize a payee to initiate the wire.

To review the Wire services, please refer to the Money Movement / Wire section in our API reference.

Mobile Check Deposit

Mobile Check Deposit refers to the online process of the customer taking a picture of a paper check and processing the deposit into their bank account from their online banking application. This capability is typically handled through the customer’s mobile phone and once the check image is sent to the financial institution, the deposit process is similar to the deposit process of paper checks.

To test the check deposit services, please refer to the Money Movement section in our API reference.

Infinant partners with leading industry Fintech and with financial institution Fintech to provide certain features. Get in touch with us to discuss various products production options and provider solutions that can be included.

You are ready to perform monetary transactions and expand your Fintech application into new business models.

We recommend you spend time reviewing our platform API reference and related materials within this builder site. You can start to expand your application using your builder account and keys.

To learn more about our platform, please visit the Interlace Platform API Reference.

Have a Question?

If you have any questions or are ready to move onto the go-live process, please reach out to our team for help at support@infinant.com.