Virtual Accounts Guide

Overview

Virtual accounts represent a holding account that is maintained “above-the-core” (outside your traditional core banking platform). Each virtual account holds a customer deposit type and has a unique account number assigned and is associated with a customer. Each virtual account is associated with a settlement account that does reside on the core banking system (of a bank) and thus retains a routing number as well. They can be used to send and receive money on behalf of the settlement account, where the funds are ultimately held. Businesses tend to create multiple virtual accounts, with each one designated to a specific client, transaction, entity, or any other business reason. For Banks, this is also a way to lower operational costs by not having to put all customer accounts on the legacy core platform. The banks offer this model to fintech and brands as an advantage while also passing through FDIC insurance for the virtual accounts.

FBO Accounts (or Omnibus)

An FBO account, or a *For Benefit Of* account, allows a fintech or brand to manage funds on behalf of—or ``for the benefit of``—one or more of their users, so they can organize a large volume of virtual accounts under a single settlement account at the bank. Our Virtual Ledger system tracks all funding and provides full transparency to each virtual account and money movement transaction.

Omnibus accounts, also often referred to as a cash management account is a similar model where transactions across two or more parties are combined under one holding or settlement account. This allows for the bank to manage a customer’s accounts as a single entity and take advantage of cash management, money distribution efficiencies, lower operating costs, and anonymity.

Creating Virtual Accounts

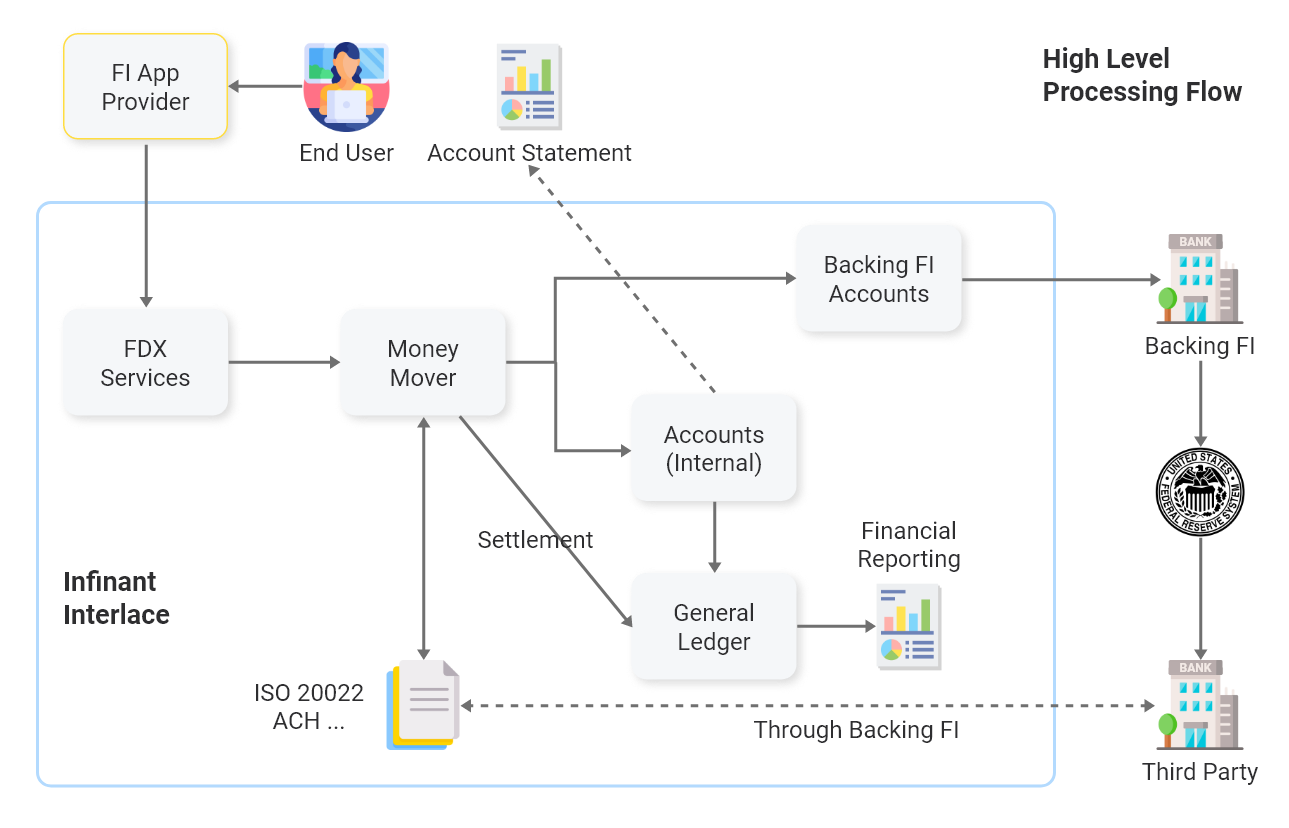

On the interlace platform, a virtual account is created through our Customer and Account Content Pack APIs. The APIs provide an orchestrated flow that allow a digital application to gather relevant customer information so that we can verify and authenticate the customer through KYC procedures, create the customer record and then create the specific product-type account on our system. Access to creating a customer and account record is secured and can only take place through our interlace platform APIs as an approved and authenticated application.

Once created, the virtual account can be viewed and serviced through our interlace Management Console.

Virtual Account Funding and Money Movement

There are a variety of methods to move money into and out of a virtual account including external transfers, internal transfers for existing customer, ACH, wires, bill pay, etc. These money movement transactions are associated with the customer and their virtual account with all transactions being housed within the interlace virtual ledger. The virtual ledger is the component that tracks all debits and credits for each account.

Virtual Ledger

When there is any money movement associated with a virtual account such as a deposit, a payment or transfer – all of the transactional debits and credits are housed within our interlace virtual ledger. The virtual ledger is a key component to the virtual account system and provides an accountable, immutable, cryptographically verifiable log of all transactions and data changes. Our event-driven system ensures data integrity with real-time streaming of data to ensure a complete history of debits and credits across accounts, processors and systems. The ledger acts as the virtual accounting system to verify customer and account funds as well as reserve funds in cases of ACH processing for instance. Our ledger also provides output files in various formats such as BAI2 or CAMT to ensure proper settlement to the bank.

Customer Servicing

At any time, our customer can access and view their customer’s profile record, their list of accounts and transaction history. In addition, our customers can view specific content of the customer related to the use of the platform, including viewing of the KYC results by customer to ensure compliance to bank policies.

Statements

As part of the virtual ledger, all transactional activity for a virtual account is accessible in the form of a bank statement. This can be retrieved by the digital application via out Content Pack API for statements or viewed by the bank from the interlace Management Console.

Settlement

Virtual accounts are typically backed by an FBO account opened at a partner bank where the aggregated funds for the virtual accounts are stored and typically backed by a reserve account used as buffer in the case of disputes, fraud, returns and other anomalies. The interlace virtual ledger produces settlement and activity reports used by the partner bank to settle funds on a daily basis and perform audit activity required for regulatory purposes. Settlement files are produced systematically on a schedule and can also be viewed and manually generated through the interlace Management Console.

Webhooks

To notify your customers or your digital application of certain customer and account activity, the interlace platform provides webhook support. Review the interlace webhook section for a listing of various webhooks you can subscribe to.